Who are you? Or more specifically; What are you? Are you an employee, an independent contractor, a part-time employee, sole proprietorship, limited liability corporation or S or C corporation?

You may not personally care about the exact verbiage, but I can assure you of, is that prospective clients will. More importantly, your state Worker’s Compensation Board and the IRS, or national equivalent in the country which you reside, are extremely interested.

While the insurance aspect of our industry is definitely not as sexy as talking about guns, ninja moves or the latest and greatest electronics, I can assure you that insurance or more specifically the lack of proper insurance, bankrupts more independent contractors than just about any other source of outside influence. Specifically, I would like to take a moment to speak to you about workers compensation. For the sake of this article, I will only be speaking to the requirements for working within the United States and its boundaries, working overseas, especially working for government entities and high-risk areas is a completely separate discussion, as the Defense base act is a whole separate animal onto itself.

Who should pay the medical bills if I get hurt while I am out with a client? There has been a lot of talk on social media as well as some questions and concerns from people/entities who I look to do business with in regards to this very subject. It never ceases to amaze me that if you are asking that question, then you really don’t know who you are and what you are in this relationship. Most people who have been in business for several years know the answers to these questions because they know that it will either be the employer’s workers compensation insurance policy or their own Worker’s Compensation policy if they are truly an independent contractor and a licensed business entity. But it seems that the answer is never that simple.

Workers’ compensation requirements in the United States began early in the 20th century, back in 1911.

In the old days, it used to be easy to distinguish an employee from an independent contractor; the employee had withholdings taken out of their check, the independent contractor didn’t. Then the IRS realized they were losing $30 billion dollars (estimated) a year in tax revenue where employees were misclassified as independent contractors. Now every IRS audit looks into whether workers are being classified correctly.

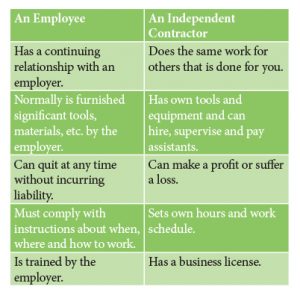

What is the difference between an employee and an independent contractor?

Many factors are considered when determining whether someone is an employee or independent contractor. Some of those factors are: Independent contractors set their own hours, use their own tools, work when and for whom they choose, and are responsible for paying their own State and Federal withholdings.

Who is an independent contractor?

An independent contractor is someone who maintains an independent business and is available for hire to provide service to the public. Generally, a person cannot become an independent contractor just because he or she wants to be or because an employer prefers them to be. It is not enough that the employee and the employer agree. If a person only works for one business and is directed and controlled by that business, the person probably is an employee and not an independent contractor.

Workers’ Comp, do you need it?

That may be the first important question that a business needs to address, because not every business is required to purchase workers’ compensation insurance. Generally speaking, sole proprietors and partnerships aren’t required to purchase workers’ compensation insurance unless and until they have employees who aren’t owners. Though-these rules vary from state to state and can change over time. So it’s always a good idea to check with your particular state’s regulatory agency to make sure what the rules are for your state jurisdiction. A few states even give employers the option to not purchase workers’ compensation insurance at all. Just because the state may allow an employer to go without workers’ compensation insurance, the employer is still liable under the state’s workers’ compensation laws for injured workers. Not having workers’ compensation insurance, even if allowed by a particular state, does not relieve the employer of financial responsibility for injured workers.

Let’s say you’re operating as a sole proprietor and your state doesn’t require you to purchase workers’ compensation insurance for yourself. Then you hire a protection agent. If that protection agent doesn’t have workers’ compensation insurance on himself and gets hurt working on your premises, he may well be able to make a claim against you. I hope this gives you some pause in response to the never-ending rebuttal by some providers that state, “ I am covered under my retired (LEO, military or any other) health benefits.” That’s why many larger companies will contractually require anyone doing work for them to show proof of workers’ compensation insurance.

One of the key advantages of workers’ compensation laws for an employer is the limitation on the right of the injured employee to sue the employer. In effect, the employer makes a trade with the employee. The employee automatically receives benefits for being injured on the job, even if the injury was partially or entirely the employee’s fault, and the employee gives up the right to sue to recover damages for those injuries in court, even if the employer was at fault. In today’s litigious society any protection against the open-ended damages that a court might award is a valuable benefit. As Mr Franklin stated, “A penny saved is a penny earned.”

Yet, if the injured person is an independent contractor, no workers’ compensation benefits are received, which means that there’s no limitation on their ability to sue the business for whatever damages the court will award. In effect, when you elect to use an independent contractor instead of an employee, you might be trading immediate and limited savings on your workers’ compensation premium for exposure to legal damages that could easily exceed the normal general liability policy limit of $1,000,000.

Obviously, this is a short summary of the subject and not to be construed as a cookie-cutter solution to the problem. As the problem itself is multifaceted, but hopefully, it will serve as a productive template and base foundation for your future endeavors.

Suggestions to give you some peace of mind:

1. Buy a workers’ compensation policy – even if you think you don’t have any employees. Whether you have employees or not, buy a workers’ compensation policy. Then, along with your general liability policy, you will have protection from either employee or independent contractor injuries. Don’t wait until an injury to find out who you thought was an independent contractor has been determined to be an employee and you didn’t buy workers’ compensation insurance.

Many insurance companies will sell you a workers’ compensation policy, even with no employees, and only charge you their minimum policy premium.

2. Make certain the independent contractors you do hire have their own workers’ compensation insurance. Have them furnish you with evidence of coverage with a Certificate of Insurance. And mark their policy expiration down on your calendar to remind yourself to request a renewal Certificate before their policy expires. (While you’re at it, make sure their general liability coverage is also listed on the Certificate and that you’re named as an Additional Insured)

Your workers’ compensation insurance company will want to see copies of your independent contractor’s workers’ compensation Certificates. Without the Certificates, your carrier may consider the independent contractors your employee and charge you an additional workers’ compensation premium.

Do you know what you are? By: Raffaele Di Giorgio

Raffaele Di Giorgio is the CEO of Global Options & Solutions and an active Operator within the circuit. For more information visit www.GOS911.com

The Harvard and UC Berkley of Executive Protection . Just a breath of fresh air adding this too your EP business vernacular ! Excellent read !!!